In life, debt relationships are types of relationships that occur frequently. However, not always does the debt collection go smoothly. If a party has problems in his business or commercial activities, it may incur a debt or borrower may not be able to pay the debt when it is due, all of those situations will result in disputes of debt collection. Currently, the dispute settlement cases on debts collection are increasingly concerned because the value of the debts is increasing. However, the fact of settling debts collection disputes shows that creditors tend to collect debts at the end of the year because they need money to settle financial obligations and prepare for the new year. Even so, is collecting debts at the end of the year really effective and reasonable? If not, what time of the year is most reasonable for creditors to collect debts? This article will clarify these questions.

1. Collecting debts at the end of the year is really effective and reasonable, isn’t it?

The end of the year is the time for organizations and individuals to conclude the results of business and commercial activities in a year. This is also the time when organizations and individuals must finalize tax and pay amounts of salaries, bonuses to employees and other financial obligations to competent state agencies. Therefore, creditors want to collect debts at this time to avoid financial loss, to save capital for next year’s business activities after tax finalization and other financial obligations under the laws.

In addition, debts collection cases often happen more at the end of the year because every individual needs money to prepare for the new year. Lunar New Year (“Tet holiday”) is an important traditional holiday of Vietnam, so everyone wishes to have more money so that they can be able to buy things for the new year and their families. Collecting a debt successfully can means a lot to creditors and their families. Besides that, it is customary in Vietnam for people to abstain from debts collection and payments at the beginning of the year, so most creditors have the demand to collect debts at the end of the year to avoid collecting debts at the beginning of the next year.

However, whether the debts collection is smooth and effective or not, it is largely based on the borrower’s ability to repay. If the year-end is a time when creditors fulfill their financial obligations and prepare for the new year, so are the borrowers. This will affect the borrower’s ability to repay. Therefore, it can be said that the year-end is not really a good time for creditors to conduct debts collection.

2. What time of the year is most reasonable for creditors to collect debts?

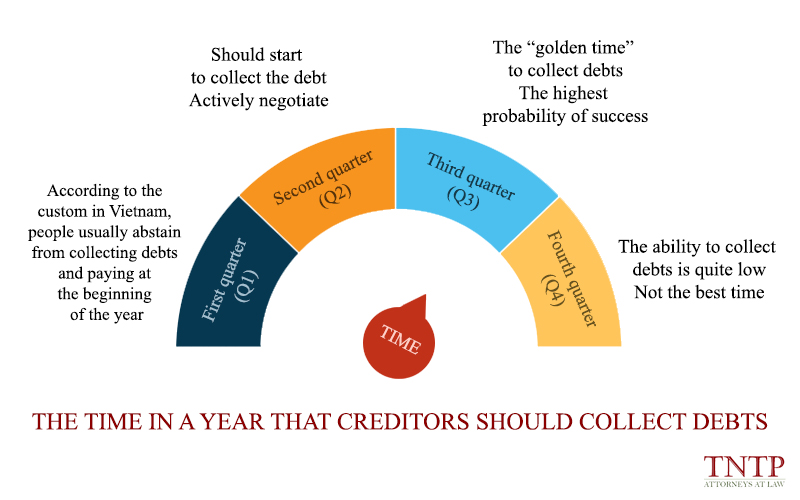

As mentioned above, in the first quarter of the year, people often abstain from collecting debts at the beginning of the year. After the Tet holiday, creditors should not collect debts because borrowers spent money during the Tet holiday so they may have no money to repay. Therefore, the first quarter is not a suitable time for debts collection. Moreover, the beginning of the year is the time when most individuals and organizations start using money to invest and conduct business activities, so they may not have enough money to pay debts.

The creditors should start collecting debts in the second quarter of the year because at this point, the borrower’s business activities begin to be profitable, so it will be possible to repay debts. However, the amount of debts that collected in the second quarter may not much due to low profit. At this time, creditors should actively negotiate so that borrowers have time to arrange repayment.

The third quarter of the year is the “golden time” for creditors to collect debts because business activities in the third quarter are usually most stable and the profit generated is enough for borrowers to repay debts in a timely manner. In fact, collecting debts in the third quarter is also likely to be the highest success. Therefore, at this time, creditors should actively ask borrowers to repay debts.

In the fourth quarter of the year, creditors can collect debts easily if borrower’s business activities have good result at the end of the year. However, the year-end is the time when not only creditors but also borrowers have to pay amounts such as tax finalization, fulfill financial obligations and prepare for the new year. Whether creditors collect debts successfully or not depends on borrower’s solvency. So that in fact, the ability to collect debts in the fourth quarter is quite low.

From the above analysis, it can be concluded that the year-end is not the best time of the year for creditors to collect debts. The time when creditors should collect debts is the third quarter when borrowers are able to repay debts from profits in business and commercial activities. However, if creditors want to collect debts at the end of the year, this is quite the good time to prepare to collect debts for debts arising next year.

In case you have any legal problems of debts collection, please send us your information and case.

Best regards.

You may need Legal service of debt collection in civil contracts

Join Fanpage Dispute Settlement And Debt Collection to have more useful legal knowledge.

TNTP & Associates International Law Firm

Lawyer Nguyen Thanh Ha

Email: ha.nguyen@tntplaw.com