Since the debt arose, what time should creditors collect the debt?

Nowadays, there are more and more disputes about debts collection, which is leading to an increase in the demand of finding the assistance of enterprises in the field of debts collection. In the last article, we analyzed the time in a year that creditors should collect the debt. However, only considering the time in a year to collect the debt is not enough because if the debt has arisen for a long time and the party obliged to pay the debt do not intend to repay or they evade creditors, debt collection will not be effective no matter when creditors collect the debt in a year. Therefore, creditors need to consider collecting the debt when the debt starts to arise so that creditors can protect their rights and benefits. So since the debt arose, what time should creditors collect the debt? What should creditors do at times to collect the debt effectively? This article would clarify these questions.

1. What is the time when the debt arises?

In practice, the debt arises from purchase and business activities or through loan agreements. Therefore, the time when the debt arises is the due date of payment but the party obliged to pay the debt does not pay money, the loaned property to lenders or creditors as agreed or notified.

With purchase and business agreements, the time when the debt arises is the time when a party incurs a payment obligation as agreed by the parties but the party obliged to pay fails to implement the payment when it is due. In particular, the time of arising payment obligation may be specified by the parties in the contract or by other forms.

In principle, the debt should be collected as close to the date it arises as to possible because the obliged party still has the ability to repay the debt at that time. Thus, negotiating and contracting to the obliged party would be easier. In addition, if creditors want to initiate a lawsuit to collect the debt, they shall pay attention to the statute of limitations for initiating a lawsuit and the attitude, solvency of the obliged party. When the debt arises for too long, the statute of limitations for initiating a lawsuit expires, the obliged party is incapable of repaying the debt, which will make it difficult to collect the debt.

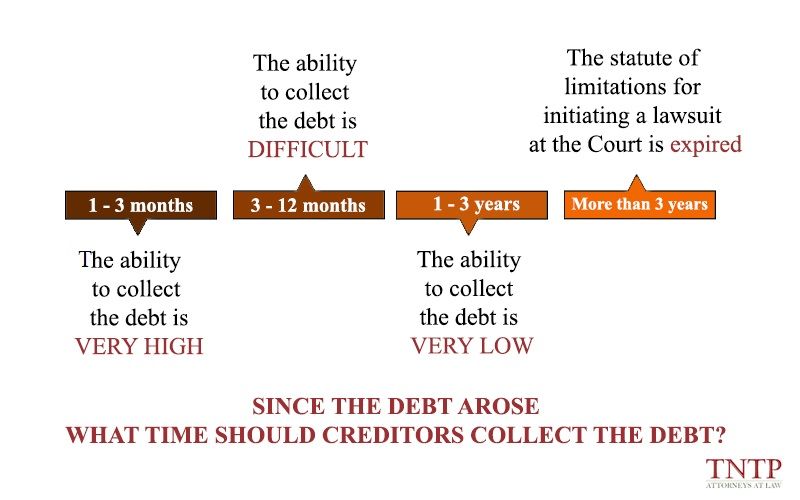

2. Since the debt arose, what time should creditors collect the debt?

In the period from the first 1 month to 3 months since the debt arose, the ability to collect the debt is highest and relatively easy. At this time, the deferred interest of the principal balance of a loan has almost not arisen yet or has just arisen a few, so that the obliged party may arrange to repay the debt in a short time. Creditors can negotiate by themselves with the obliged party to ask them to repay the debt. During this period, in order to collect the debt effectively, creditors should regularly urge and remind but avoid threatening and putting pressure on debtors, causing debtors’ psychology to falter and not want to repay.

In the period from 3 months to 12 months since the debt arose, the ability to collect the debt is more difficult and it takes more effort because deferred interest starts to arise, which causes the total debt to increase and the obliged party will start to be flinching as they do not have enough money to repay the debt. At this time, creditors should take tougher and more drastic actions to collect the debt such as sending letter of demand for debt repayment, taking legal actions such as initiate a lawsuit at competent court so that the obliged party must repay the debt under the law.

From 1 year to 3 years, the ability to collect the debt is very difficult because the obliged party is almost unable to pay the debt, together with the interest of the principal balance of the loan and deferred interest have arisen and become a big mount. At this time, the obliged party may evade the debt and make it impossible for creditors to contact. Therefore, if the debt has arisen from 1 year to 3 years, creditors should seek the assistance of lawyers and businesses specializing in debt collection. The legal actions that creditors can take at this time are initiating a lawsuit at competent court and/or reporting the crime of Obtaining property by fraud, then requesting competent agencies to investigate and find out the residence of the obliged party and force them to repay the debt.

For cases in which the debt has arisen over 3 years, based on Article 429 of the Civil Code 2015, the statute of limitations for initiating lawsuits to request the Court to settle contractual disputes has expired. However, under the current law and in practice, creditors can sue and be accepted by the Court even when the statute of limitations for initiating lawsuits has expired. Therefore, creditors may consider initiating a lawsuit against the obliged party even though the debt has arisen over 3 years.

However, creditors should note that the ability to collect the debt depends largely on the repayment capacity of the obliged party. Creditors should avoid letting the debt arise for more than 3 years because debt collection will be very difficult then even if creditors initiate a lawsuit at competent Court because the debt has been incurred for too long, the ability to collect the total debt is very small. In addition, the case settlement and judgment execution will take much time and effort.

Based on the factors analyzed above, creditors can consider and choose for themselves the appropriate time and action to collect the debt. In case you have any legal problems regarding debts collection, please send us your information and legal issue.

Best regards.

You may need Legal service of debt collection in commercial activities

Join Fanpage Dispute Settlement And Debt Collection to have more useful legal knowledge.

TNTP & Associates International Law Firm

Lawyer Nguyen Thanh Ha

Email: ha.nguyen@tntplaw.com