Debt collection service is prohibited – Which directions for creditors?

At the 9th Session of the XIV National Assembly of the Socialist Republic of Vietnam on June 2020, the National Assembly accepted the Investment Law No. 61/2020/QH14. In which, the Investment Law has many contents amended, supplemented and improved to the Investment Law 2014. Particularly, a content that social communities are interested in the Investment Law 2020 (is effective on January 2021) is that debt collection service is prohibited.

However, many people wonder whether the prohibition of the debt collection service will affect the debt collection service of law firms or not and in practice, after the Investment Law 2020 has the effect, how can individuals and companies recover the uncollectible accounts? To answer this question, TNTP would like to share our legal view of the prohibition of debt collection service in the Investment Law 2020.

1. What is the debt collection service?

The business line of debt collection service is regulated in Decree No. 104/2007/ND-CP dated June, 2007 “On debt collection service business”.

Accordingly, it can be understood that the debt collection service business is that enterprise represents the creditor or the debtor to perform debt collection service according to regulations includes: determine debts, urge debtors to pay debts, collect debts; measures to deal with creditors; legal advice for creditors or debtors to determine debts, measures, processes, procedures for debt settlement, …

2. Are the debt collection enterprises and the law firms representing clients to solve disputes for the debt the same?

Many people think debt collection enterprises and law firms representing clients to solve disputes for the debt are the same because debt collection services and debt dispute settlement have some the following common points:

- Debts arise from civil loan contracts or from commercial business activities

- Debt collection enterprises and law firms both represent the client (the Creditor or the Debtor) to perform appropriate works to recover the debt for the client (in case the client is Creditor) or have solutions against the creditor (in case the client is Debtor)

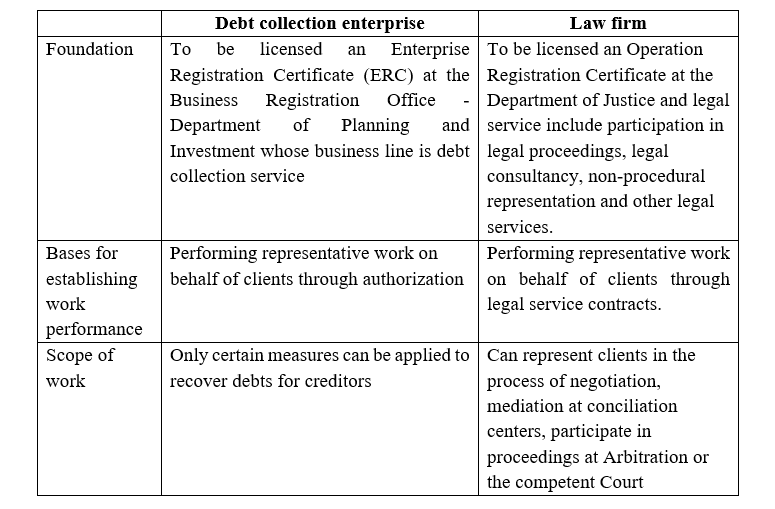

However, according to the regulations of the law, the debt collection service of the debt collection enterprises and the representation to clients to resolve the debts of law firms are not the same: Thus, the debt collection enterprises’ debt collection service and law firms’ representation of debt settlement are not the same. Debt collection service is prohibited but does not affect any legal service of the Law Firm.

Thus, the debt collection enterprises’ debt collection service and law firms’ representation of debt settlement are not the same. Debt collection service is prohibited but does not affect any legal service of the Law Firm.

3. Measures of debt collection after the Investment Law 2020 has an effect?

The Investment Law 2020 will have an effect on January 2021, and pursuant to Article 6 of the Investment Law 2020, debt collection service is prohibited. Therefore, creditors can choose two options to handle the debt:

- Transferring the right to the debt (or selling the debt). By this way, creditors can recover a part of the value of the debt and do not need to worry about measures to urge debtors to repay the debt. However, creditors should be aware that for bad debts, the possibility of the transferable rights to the debt is quite low and the value of the transfer will not bring benefit to the creditors.

- Use legal services of lawyers: As being analyzed above, the prohibition on debt collection services does not affect the legal services of law firms, including representing clients to negotiate with the parties and participating in proceedings at Arbitration or Court to request the debtor to pay the debt. In addition, due to the fear of lawsuits of the parties, when there is the participation of lawyers in the proceedings, the debtor often cannot defect, evade obligations anymore, therefore, the ability to recover the debt successfully will be higher.

With experience in dispute settlement and debt collection for years, TNTP has found that the plan of using legal services of lawyers is more possible. Compared with the transfer of rights to debt, creditors must accept that they can just recover a part of the debt and the loss is bigger than the interest, so hiring lawyers will be more recoverable. If the debt recovery is successful, creditors can recover not only the original debt but also the interest. Therefore, creditors should carefully consider debt recovery measures to get the best benefit.

Above are legal shares of TNTP about the issue “Debt collection service is prohibited– Which directions for creditors?”. Hope this article is useful to you.

Best regards.

You may need Business’s basic steps for debt collection.

Join Fanpage Dispute Settlement and Debt Collection to have more useful legal knowledge.

TNTP and Associates International Law Firm

Lawyer Nguyen Thanh Ha

Email: ha.nguyen@tntplaw.com