The process of debt collection for businesses

Debt collection is currently one of the essential needs for businesses to maintain their stable source of capital. However, not all businesses are familiar with the process of debt collection. In this article, TNTP will analyze and provide a debt collection process for customers to refer to in their operations.

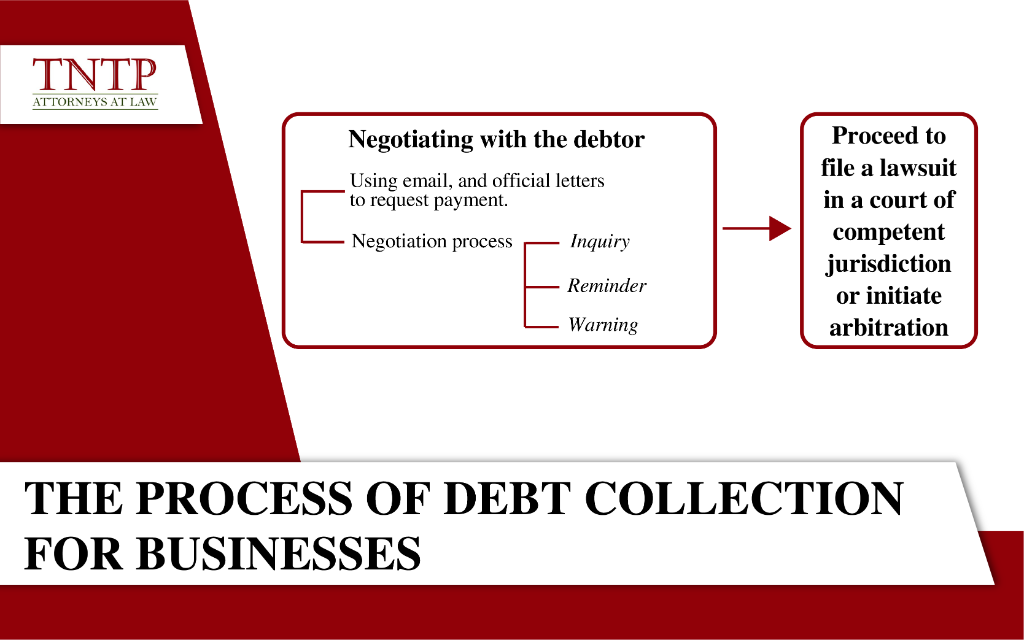

1. Negotiating with the debtor

Before taking further measures to collect the debt, the first step is to negotiate and exchange to determine the debtor’s willingness to pay. Specifically, through the following ways:

1.1 Using email, and official letters to request payment.

The purpose of the request for payment letter is to gauge the debtor’s willingness to pay. In reality, the percentage of debtors who decide to pay back the business when the business sends a request for a payment letter is relatively low. However, this is an option worth trying because contacting through email and official letters is relatively fast and cost-effective. In addition, the request for a payment letter is also necessary evidence to create an advantage in resolving disputes at the competent state agency.

1.2 Negotiation process

The process of negotiating to recover the debt can be divided into several stages. Depending on each stage, businesses can use different negotiation skills. To negotiate with the debtor effectively, businesses can refer to some of the following skills:

• Inquiry stage: When the payment deadline is approaching and the debtor has not responded, the business can call, email, or send a letter to remind the debtor to fulfill their obligations according to the law. This stage is carried out in a gentle and sympathetic spirit towards the debtor’s delay, and at the same time, the business can extend a specific payment deadline (usually within 1 week).

• Reminder stage: After the business has extended the deadline for the debtor, but the debtor still has not fulfilled their payment obligation, the business can remind them more strongly to cooperate in resolving the debt through negotiation between the two parties. However, the business should still show goodwill and trust that the debtor will fulfill their payment obligations in full.

• Warning stage: If the debtor continues to fail to meet the deadline, the business needs to show a stricter attitude towards demanding payment and may indicate the legal consequences if the debtor fails to fulfill their payment obligation. This time, the business should ask the debtor to commit to payment in writing to ensure that the debtor fulfills their obligation. In case the debtor fails to fulfill the commitment, this document will be submitted to the competent court as evidence of the debtor’s uncooperative attitude in resolving the debt.

In case the debtor does not cooperate in payment, the enterprise may consider filing a lawsuit at the competent dispute settlement agency.

2. Proceed to file a lawsuit in a court of competent jurisdiction or initiate arbitration

After determining that the debtor has no willingness to pay the debt, the enterprise has the right to initiate legal proceedings to request the court or arbitration to resolve the dispute and recover the debt from the debtor if three conditions are met simultaneously: (i) a debt arises and the debtor does not repay it as promised, leading to a dispute, and the enterprise believes that its rights and interests have been infringed; (ii) the dispute between the enterprise and the debtor must fall within the jurisdiction of the court or arbitration, not any other agency or organization; (iii) in some cases, if there is an agreement or mandatory legal regulations that require pre-litigation procedures such as conciliation, negotiation, notification, etc., the enterprise must complete those procedures before requesting the competent authority to settle the dispute between the enterprise and the debtor.

Litigation can be costly, time-consuming, and require effort, so the enterprise needs to consider whether the benefits are worth the debt that can be recovered. From there, the enterprise can proceed to file a lawsuit in a court of competent jurisdiction or initiate arbitration as provided by law.

Best regard.