Suitable time for debt collection

In business activities, it is usual that companies encounter the scenario of late payment from their partners. Sometimes, these late payments are prolonged and converted into bad debts or irrecoverable debts, which hinders the debt collection and put the companies under financial pressure. Therefore, in order to achieve optimal efficiency in debt collection, the in-charge person needs to anticipate possible debtor’s reactions to have the most effective handling, and at the same time, identify the suitable time for debt collection, accordingly, finding a reasonable solution.

1. Suitable time for debt collection

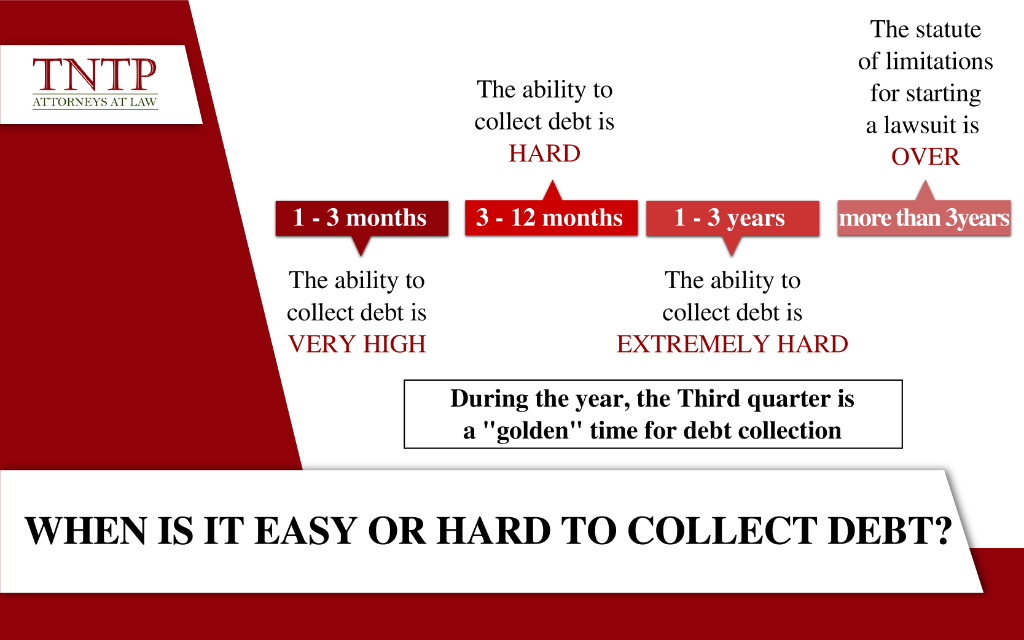

Firstly, regarding the suitable time for debt collection since the debt arises: it will be the period from the 1st to the 3rd month since the debt arises.

Therefore, as soon as the debt arises, companies should take measures to collect debts, avoiding the possibility that the debt is prolonged leading to becoming irrecoverable one, affecting business operations.

Secondly, regarding the suitable time for debt collection in a year: Companies can refer to the article “When should companies collect debts during the year?”. The third quarter of a year is a “golden” time for companies to collect debts. The first and second quarters are the beginning of the year, when the debtor’s business has just started to make a profit, hence, there is a possibility that they can arrange the payment but not high. The fourth quarter, the end of the year, is the time when businesses have to summarize revenues and expenditures and have many payables, given so, it is not an appropriate time to collect debts.

Therefore, companies should conduct the debt collection in the third quarter of the year.

2. Bad time for debt collection

The period from 03 to 12 months since the debt arises, the possibility of debt collection is not high. For the period of 1 year or more, the chance of success is low. Debts pending over 3 years are usually not recoverable. Therefore, companies need to prepare appropriate strategies and handling methods for these debts.

In addition, the companies’ status should also be taken into account regarding the possibility of debt collection, for example, the companies are making losses, going bankrupt, or restoring production. For companies that are making losses or going bankrupt, the possibility of debt collection is very low, because they are falling into insolvency at this time.

Basically, when the debtor falls into the insolvency state, the chance of success for debt collection is very low and at this time, the lenders need to consider making a request to the Court so that the case can be promptly handled in the enforcement phase as to the remaining assets of the debtor. For companies that are in the process of restoring production, debt collection is rather challenging because, at this time, they need to focus on investment in goods supply and production activities.

The chance of success largely on the debt collection methods, accordingly, companies should find a law firm specializing in bad debt handling in the beginning, to not waste money nor miss the suitable time for debt collection. Companies should also avoid keeping the debts pending for more than 3 years because then it will be very difficult to collect debts even if they initiate lawsuits at competent courts. As debts have arisen and are pending for too long, there is a risk that the debtor no longer has any assets to execute the judgment.

Above are our legal advice about the suitable or bad time for debt collection. Hope this information is useful for companies.

Sincerely,