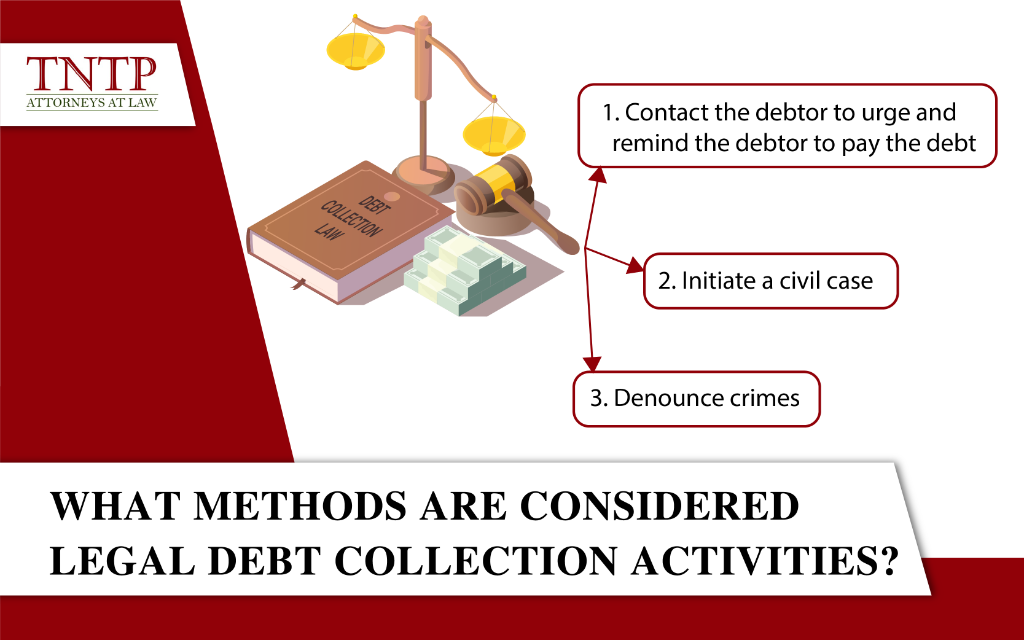

What methods are considered legal debt collection activities?

Many people only know about prohibited debt collection activities and believe debt collection is illegal. However, there are still legal debt collection activities carried out so far. What are the methods of debt collection? What should be kept in mind when implementing those methods? The article “What methods are considered legal debt collection activities?” will answer the above legal question.

1. Contact the debtor to urge and remind the debtor to pay the debt

The first legal debt collection activity is to contact the debtor to urge and remind the debtor to pay the debt. Currently, the ways to contact the debtor are:

Meet face to face. It is a traditional method that has better advantages than calling and sending. Face-to-face meetings have the highest probability of successful negotiation of all the ways of contact. In addition, the entitled party can assess the debtor’s goodwill towards debt repayment if the debtor agrees to meet. However, face-to-face meetings also have the disadvantage of being more difficult to schedule than other ways of contacting. Besides, not all debtors agree to meet with debt collectors.

Note: To collect debt legally, when meeting, the entitled party needs to control their emotions well, use appropriate words, and not offend the honor and dignity of the debtor.

It is also a flexible way of contacting, which helps the parties to exchange and find a solution without having to arrange a time. However, calling will only be helpful when the debtor is willing and proactive. In addition, calling has a large disadvantage that the content of the discussion is often not considered evidence if initiating a lawsuit at a competent authority.

Note: The entitled party may only call within the time and number of times permitted by the law. Specifically, the entitled party has the right to call to urge and remind the debtor up to 5 times/day and in the period from 7 a.m to 9 p.m.

Send documents, and letters to request payment or confirm debts by email or post. This method of debt collection is very common if the debtor is a company or enterprise. Sending a document, or letter of payment request has a great advantage that it can become evidence if it has legal effect and is accepted by a competent authority. With corporate debtors, the rate of initiating a lawsuit is higher than the debts of individuals. The entitled party should pay attention to this and send documents to the debtor regularly.

Note: Documents and scans need to be signed, stamped, and saved with proof that the entitled party has sent the documents (For example: receipts, postal notices, and mailing screens …) In this way, these documents will have a legal effect and can be considered evidence if the entitled party initiates a lawsuit against the debtor later.

2. Initiate a civil case

In case the debtor fails to pay the debt despite urging and reminding, the entitled party can initiate a civil lawsuit. It is one of the legal debt collection activities to protect the legitimate rights and interests of the entitled party.

If you wish to initiate a civil action, the entitled party should identify and clarify some things as follows:

- Is the debtor able to pay the debt? The debtor must have money and assets to have solvency. If the debtor cannot pay, even if the entitled party initiates a lawsuit, the debt collection activity will not be successful.

- Is the debt big enough to initiate a civil case? When a lawsuit is submitted, the entitled party must know they will have to pay a cost to collect the debt. It could be the cost of hiring a lawyer; expenses for the preparation of documents and lawsuit dossiers; fees for collecting evidence during the litigation process; court fees and judgment enforcement fees (if any).

Therefore, if the entitled party wants to get a benefit, the debt must be relatively larger than the entire cost. For small debts of less than 100,000,000 VND, the entitled party is likely to lose up to ⅓, even half, for litigation. The total time for a civil case from filing a petition until the debtor pays off the debt ranges from 6 months to several years. Thus, the amount the entitled party receives after deducting all costs will not bring much benefit.

3. Denounce crimes

In some special cases, if the debtor cuts off all contacts, flees his residence, and shows signs of deception or abusing trust to appropriate property, the entitled party may denounce crimes. It is a legal debt collection activity to protect the interests of the entitled party.

Usually, the most common crimes related to debts are Fraud to appropriate property and Abuse of trust to appropriate property. In particular, the crime of fraud to appropriate property is specified in Article 174 of the Penal Code 2015 (amended and supplemented in 2017). The crime of abusing trust to appropriate property is specified in Article 175 of the Penal Code 2015. These two crimes are often confused with each other. Therefore, the entitled party should make a clear distinction to avoid being refused by the competent authority for the false denunciation of crimes.

Above are the legal debt collection activities up to now. If you are looking to collect an overdue debt, you can apply in your case. TNTP hopes the article is helpful to you.